The award-winning Value for Investment (VfI) approach is a rigorous way of determining how well resources are used in a policy or program, whether the resource use creates enough value, and how more value can be created.

We’re on a mission to share VfI, offering training, capability-building services, and free resources to support its adoption and help people provide better answers to value-for-money questions.

Combining strengths of evaluation and economics

Decision makers and stakeholders need to understand whether policies and programs are worth the resources invested in them. This is a crucial question that deserves a clear answer. The VfI approach combines economic and evaluative thinking to provide the necessary clarity.

The VfI approach was developed through doctoral research. It builds on theory from evaluation and economics, and it’s designed to be practical and useful.

How VfI works

VfI isn’t another method – it’s a system to guide the use of existing methods and tools, with a set of principles and a process to support contextually responsive evaluation.

VfI frames policies and programs as investments in value propositions, with potential to create significant social, cultural, environmental and/or economic value. The approach hinges on defining a transparent framework to make sense of evidence, aligned with the value proposition. VfI frameworks accommodate multiple sources of evidence to gain a nuanced understanding of program resources, processes, consequences, and value.

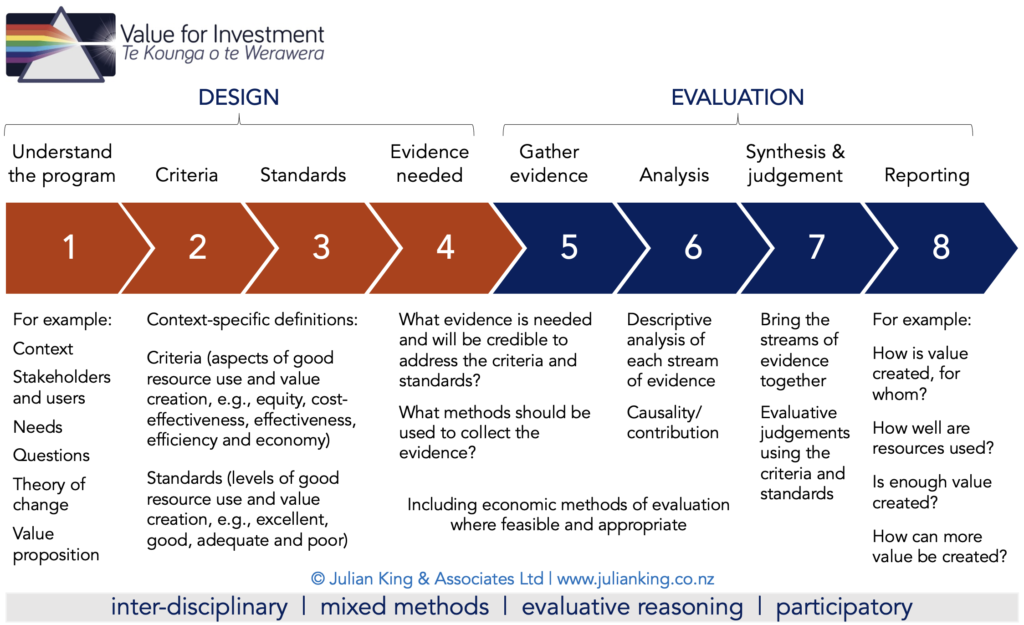

A VfI evaluation follows a sequence of eight steps. The process is designed to be collaborative and inclusive, co-creating value with stakeholders to support evaluation validity, credibility, and use.

Around the world

The VfI approach is used worldwide to evaluate complex policies and programs, ranging from one-off assessments to organisation-wide evaluation systems and performance frameworks. Government agencies, consulting firms, NGOs, bilateral and multilateral organisations use the approach. For examples, see the VfI resources page.

VfI training

VfI is taught globally through evaluation associations and in the online Master of Evaluation program at the University of Melbourne. It’s included in whole-of-government evaluation training in the UK. Private workshops are available and can be customised to organisational needs. To inquire about training and mentoring opportunities, contact Julian.

VfI resources

Open-access VfI resources are available here. You can also follow Julian on Substack where his regular posts include practical tips, deep dives on relevant topics, updates on publications and training opportunities.